Municipal Bonds: A Safe Haven for U.S. Investors in Uncertain Times

Introduction: Why the U.S. Investors Look for Safe Haven Investments

Financial markets often move up and down. Stocks rise quickly, but they can also fall sharply. Inflation, interest rate changes, global conflicts, and economic slowdowns create fear among investors. During such times, many U.S. investors search for safe haven investments that protect their money and provide a steady income.

A haven investment focuses on stability, capital protection, and predictable returns. Traditionally, assets like U.S. Treasury bonds, gold, and cash savings accounts have filled this role. However, in recent years, municipal bonds have gained strong attention as a haven for U.S. investors.

Municipal bonds offer low risk, steady income, and major tax benefits. They are backed by state and local governments and fund essential public services. Because of these features, many investors consider municipal bonds a reliable choice during market uncertainty.

In this article, you will learn what municipal bonds are, why they are considered safe, their benefits and risks, and whether they still work as a haven today. This guide uses simple language and clear examples so anyone can understand it.

What Are Municipal Bonds?

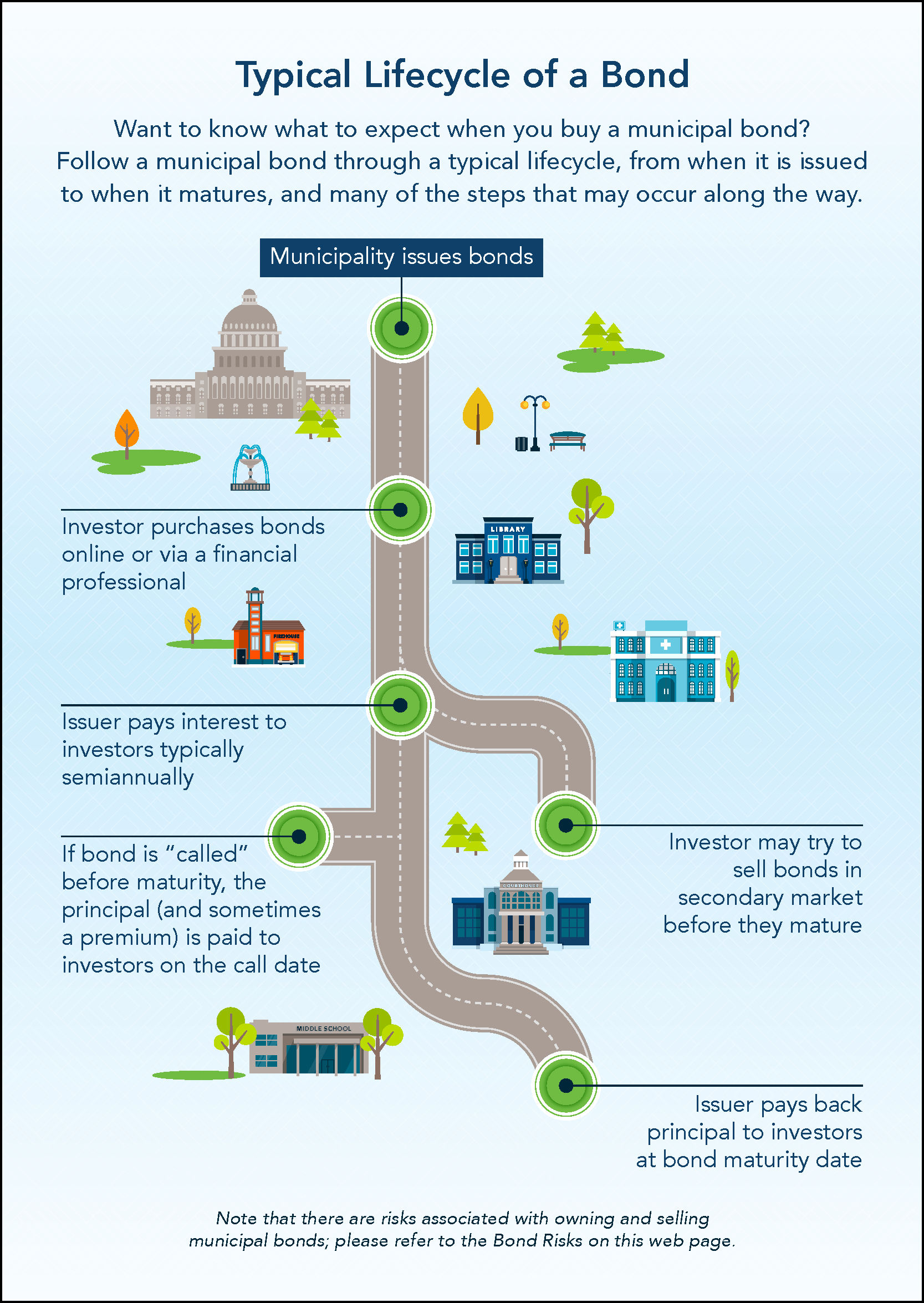

Municipal bonds, often called muni bonds, are debt securities issued by state, city, or local governments in the United States. When you buy a municipal bond, you lend money to a government entity. In return, the government pays you regular interest and returns your principal when the bond matures.

Local governments use this borrowed money to fund public projects such as:

- Schools and universities

- Roads and highways

- Water and sewage systems

- Hospitals

- Public transportation

Municipal bonds play a key role in building and maintaining U.S. infrastructure. Because these services are essential, governments prioritize bond payments even during economic stress.

One major reason U.S. investors like municipal bonds is their tax advantage. In most cases, the interest income is exempt from federal income tax under rules set by the Internal Revenue Service. Some bonds also offer state and local tax exemptions.

Compared to corporate bonds or stocks, municipal bonds focus more on income stability rather than high growth.

Why Municipal Bonds Are Considered a Safe Haven for U.S. Investors

Municipal bonds have earned their reputation as a haven over decades. Several strong reasons support this view.

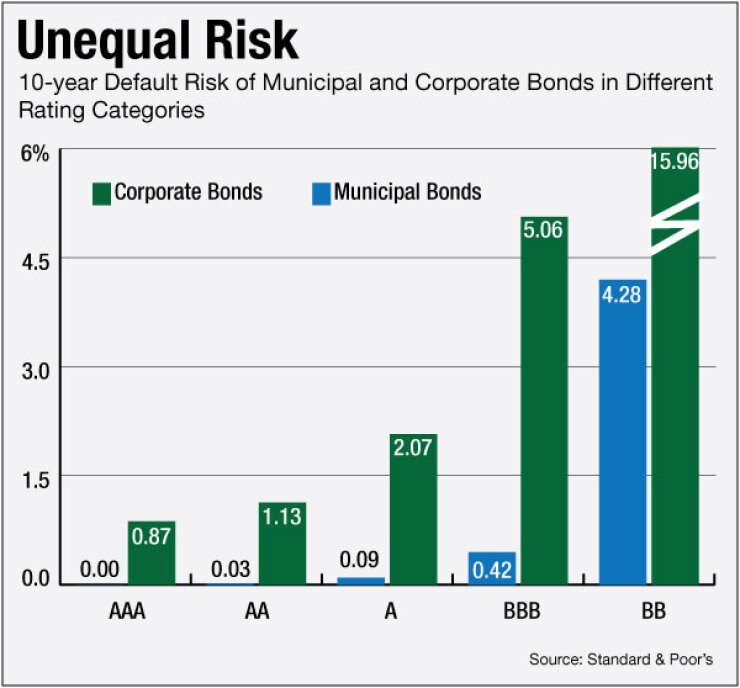

Low Default Risk

Municipal bonds have one of the lowest default rates in the bond market. State and local governments rarely fail to repay their debt. These governments collect taxes and fees that provide stable revenue.

Most municipal bonds fund essential services. People continue paying taxes, water bills, and transportation fees even during recessions. This steady income allows governments to meet their bond obligations.

Strong Government Backing

Many municipal bonds receive backing from the full taxing power of the issuing authority. This backing gives investors confidence that payments will continue even during financial stress.

Unlike corporations, governments do not aim for profit. Their main goal is to provide public services. This focus adds another layer of safety for investors.

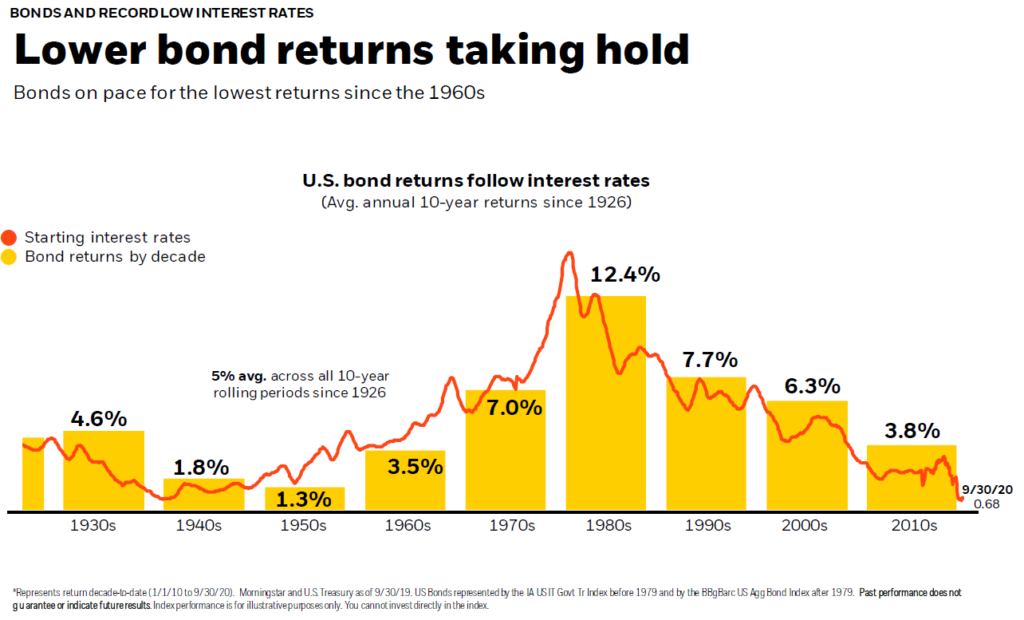

Predictable Income

Municipal bonds pay fixed interest at regular intervals. Investors know exactly how much income they will receive and when. This predictability makes municipal bonds attractive during stock market volatility.

For retirees and conservative investors, reliable income matters more than rapid growth.

Tax-Free Income Advantage

Tax efficiency is one of the biggest benefits of municipal bonds. Most municipal bond interest is free from federal income tax. For investors in high tax brackets, this feature significantly increases real returns.

When you compare after-tax income, municipal bonds often outperform taxable bonds with higher interest rates.

Types of Municipal Bonds Every Investor Should Know

Municipal bonds come in different forms. Understanding these types helps investors choose safer options.

General Obligation (GO) Bonds

General obligation bonds are backed by the full faith and credit of the issuing government. This backing means the government can raise taxes if needed to repay bondholders.

GO bonds usually fund public services such as schools and government buildings. Because of strong backing, GO bonds carry very low risk and lower interest rates.

Revenue Bonds

Revenue bonds rely on income from specific projects like toll roads, airports, or utility systems. Investors receive payments from project revenue rather than taxes.

Revenue bonds offer slightly higher interest rates than GO bonds. However, they also carry slightly higher risk if the project earns less revenue than expected.

Insured Municipal Bonds

Some municipal bonds include insurance from private companies. If the issuer fails to pay, the insurance company covers the payment.

Insurance adds another layer of protection, but usually lowers the bond’s interest rate.

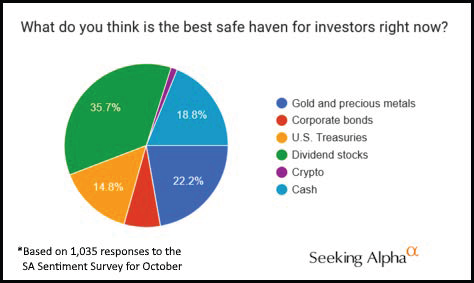

How Municipal Bonds Compare to Other Safe Haven Assets

Investors often compare municipal bonds with other traditional safe-haven investments.

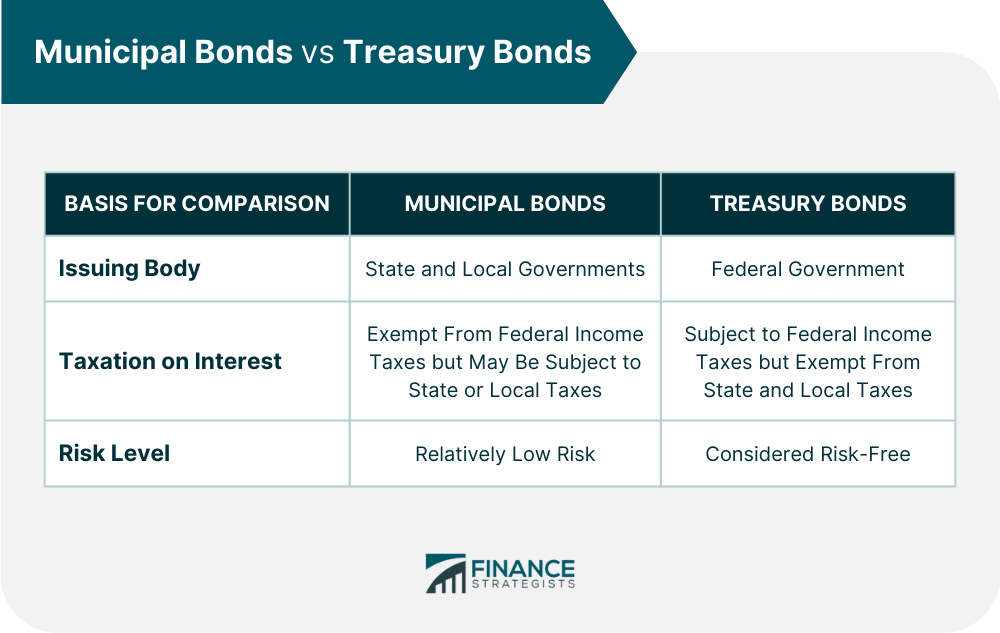

Municipal Bonds vs U.S. Treasury Bonds

U.S. Treasury bonds, issued by the federal government, are considered extremely safe. The U.S. Treasury backs them fully.

However, Treasury bond interest is taxable at the federal level, while municipal bond interest is often tax-free. For high-income investors, municipal bonds may offer better after-tax returns.

Municipal Bonds vs Gold

Gold protects against inflation and currency risk. However, gold does not generate income. Its price also fluctuates based on market sentiment.

Municipal bonds provide regular income, making them more suitable for income-focused investors.

Municipal Bonds vs High-Yield Savings Accounts

Savings accounts offer liquidity and safety but usually provide lower returns. Municipal bonds offer higher income while still maintaining relatively low risk.

Municipal Bonds vs Dividend Stocks

Dividend stocks can provide income and growth, but they carry market risk. Stock prices can drop sharply during downturns. Municipal bonds remain more stable during such periods.

Risks of Municipal Bonds You Should Understand

Even safe-haven investments carry some risks. Municipal bonds are no exception.

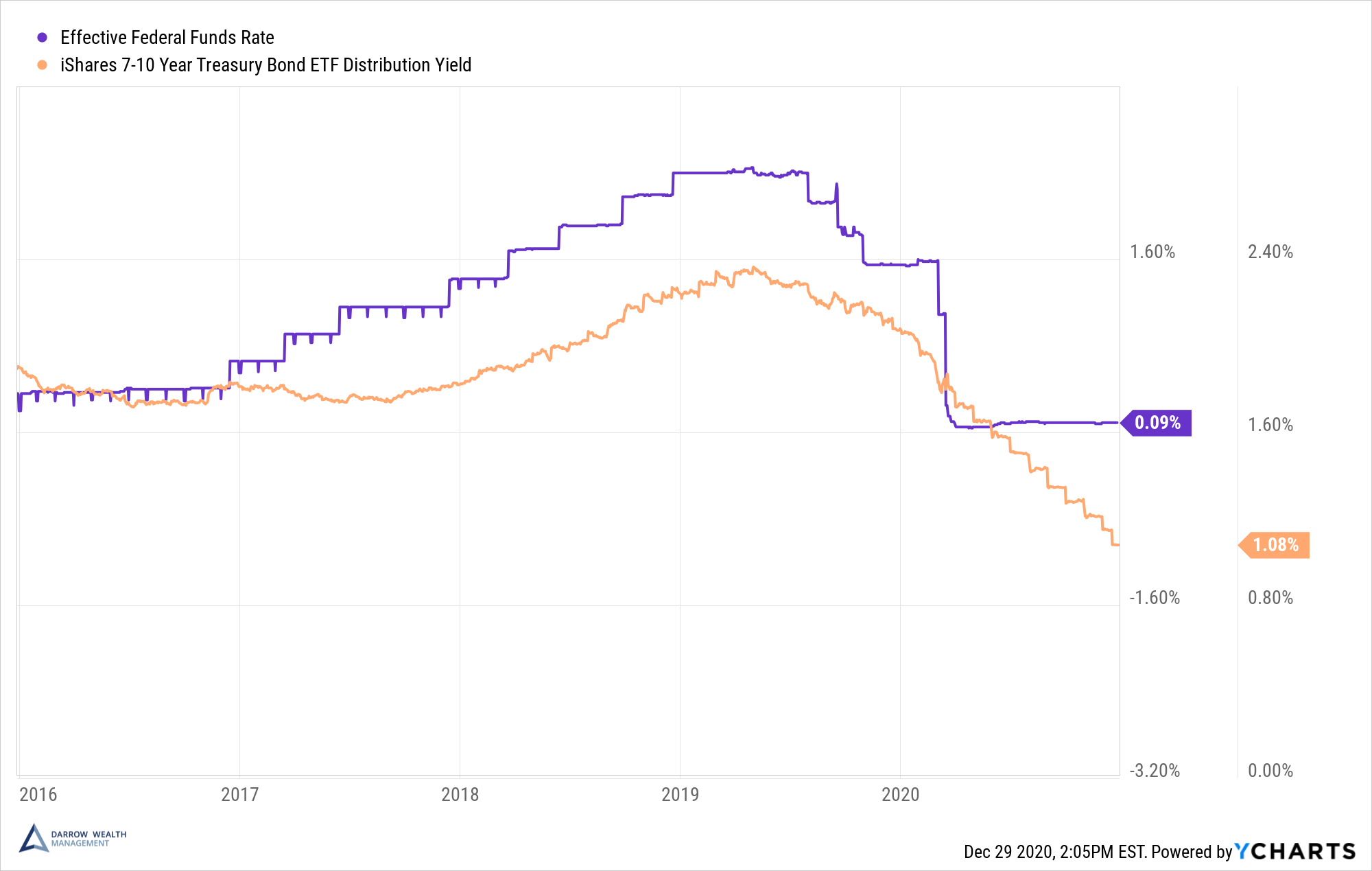

Interest Rate Risk

When interest rates rise, bond prices fall. If you sell a bond before maturity, you may receive less than you paid.

Inflation Risk

Fixed interest payments may lose purchasing power during high inflation periods.

Credit Risk

Although rare, some municipalities face financial trouble. Credit ratings help investors evaluate this risk.

Liquidity Risk

Some municipal bonds trade less frequently, making them harder to sell quickly.

Understanding these risks helps investors make smarter decisions and manage expectations.

Are Municipal Bonds Still a Safe Haven Today?

Many investors ask whether municipal bonds still work as a haven in today’s economy.

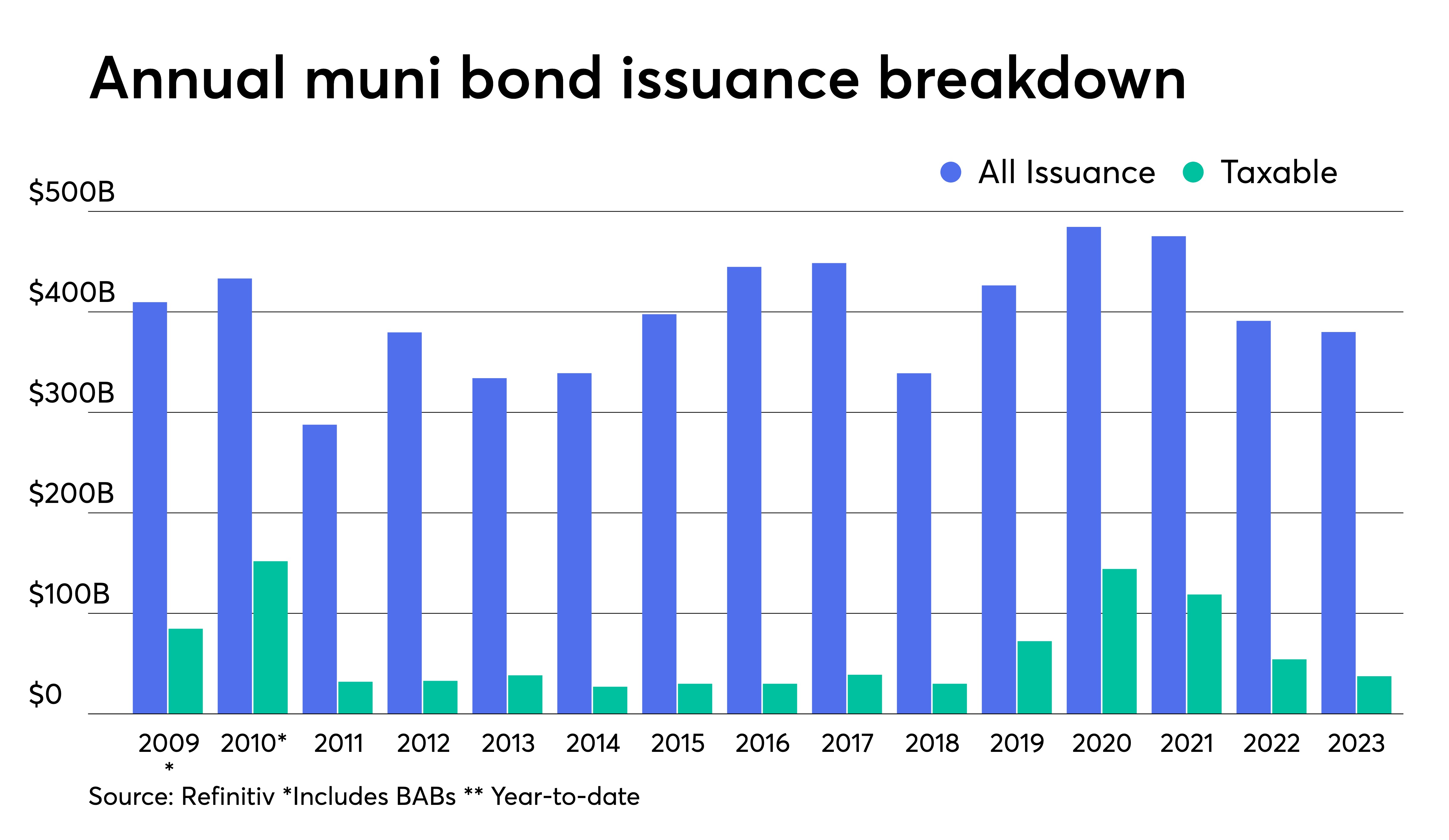

Interest rates have changed significantly in recent years. Inflation concerns and policy shifts from the Federal Reserve affect bond markets. However, municipal bonds continue to show resilience.

State and local governments maintain strong revenue streams. Infrastructure spending remains high. Demand from high-income investors also supports municipal bond prices.

For long-term investors seeking stability and tax-efficient income, municipal bonds still serve as a reliable safe haven.

Who Should Invest in Municipal Bonds?

Municipal bonds suit certain investor profiles better than others.

Ideal Investors

- High-income individuals

- Retirees seeking a steady income

- Conservative investors

- Long-term portfolio builders

Less Suitable Investors

- Short-term traders

- Investors in very low tax brackets

- Those seeking high growth

Matching investment goals with bond characteristics ensures better results.

How to Invest in Municipal Bonds

Investors can access municipal bonds through several methods.

Individual Municipal Bonds

Buying individual bonds allows investors to hold them until maturity. This approach reduces market price risk.

Municipal Bond Mutual Funds

Funds provide diversification and professional management. However, fund prices fluctuate daily.

Municipal Bond ETFs

ETFs offer liquidity and lower fees. They trade like stocks and suit active investors.

Financial Advisors

Advisors help match bond choices with financial goals and risk tolerance.

Diversification across regions and bond types improves safety.

Final Thoughts: Municipal Bonds as a Strategic Safe Haven

Municipal bonds remain a trusted haven for U.S. investors. They offer low risk, stable income, and powerful tax benefits. While no investment is completely risk-free, municipal bonds provide a strong balance between safety and return.

For investors who value income stability and capital protection, municipal bonds deserve a place in a well-diversified portfolio. With proper research and long-term planning, they can protect wealth even during uncertain economic times.

FAQs

Are municipal bonds considered a haven for U.S. investors?

Yes, municipal bonds are considered a haven because they offer low default risk, stable income, and strong government backing. They help protect investor capital during market volatility and economic uncertainty.

Why do municipal bonds have low risk compared to other investments?

Municipal bonds have low risk because state and local governments support them through taxes and public revenues. These bonds often fund essential services, making timely interest and principal payments a top priority.

Are municipal bond interest payments really tax-free?

Most municipal bond interest payments are exempt from federal income tax under rules set by the Internal Revenue Service. Some bonds also offer state and local tax exemptions, increasing after-tax returns for investors.

How do municipal bonds protect investors during market downturns?

Municipal bonds remain relatively stable when stocks fall. They provide predictable income and lower price volatility, which helps investors reduce portfolio losses and maintain steady cash flow during uncertain market conditions.

Are municipal bonds better than U.S. Treasury bonds?

Municipal bonds can be better for high-income investors because of tax-free interest. While U.S. Treasury bonds offer maximum safety, municipal bonds often deliver higher after-tax income with still relatively low risk.

Can municipal bonds lose value?

Yes, municipal bonds can lose value if interest rates rise or if investors sell before maturity. However, holding high-quality bonds until maturity usually protects the original investment amount.

Are municipal bonds a good choice for retirees?

Yes, municipal bonds work well for retirees because they provide steady, predictable income and tax efficiency. They help retirees manage living expenses while avoiding excessive market risk common with stocks.

How does inflation affect municipal bonds?

Inflation can reduce the purchasing power of fixed bond payments. However, municipal bonds still offer stability and income, making them useful for conservative investors when combined with other inflation-protected assets.

Are municipal bonds still safe in today’s economy?

Yes, municipal bonds remain safe due to stable government revenues and oversight influenced by policies from the Federal Reserve. Strong demand and infrastructure spending continue to support their long-term reliability.

How can beginners start investing in municipal bonds?

Beginners can invest through municipal bond mutual funds or ETFs for diversification. These options offer professional management, lower entry costs, and reduced risk compared to buying individual bonds directly.